Mutual Funds (SIP) in Delhi

Start mutual funds (SIP) in Delhi for the best returns from the stock market. Starting a Systematic Investment Plan (SIP) in mutual funds is a popular and convenient way for residents of Delhi to begin their investment journey towards financial goals. SIPs offer a disciplined approach to investing, allowing individuals to invest small amounts regularly over time. This method not only fosters financial discipline but also harnesses the power of rupee cost averaging to potentially maximize returns in the long run.

Benefits of SIPs in Mutual Funds

1. Affordability and Flexibility: SIPs allow investors to start with a modest amount, often as low as Rs. 500 per month. This makes it accessible for individuals with varying financial capacities to participate in wealth creation systematically. Moreover, investors can choose the frequency of their investments—monthly, quarterly, or even weekly—depending on their cash flow and financial goals.

2. Mitigation of Market Volatility: One of the key advantages of SIPs is their ability to mitigate the impact of market volatility through rupee cost averaging. When markets are high, the fixed investment buys fewer units, and when markets are low, more units are purchased. Over time, this strategy can potentially reduce the overall cost per unit and enhance returns.

3. Professional Management and Diversification: Mutual funds are managed by experienced fund managers who invest in a diversified portfolio of stocks, bonds, or other securities. This diversification spreads risk across different asset classes and companies, reducing the impact of any single investment’s performance on the overall portfolio.

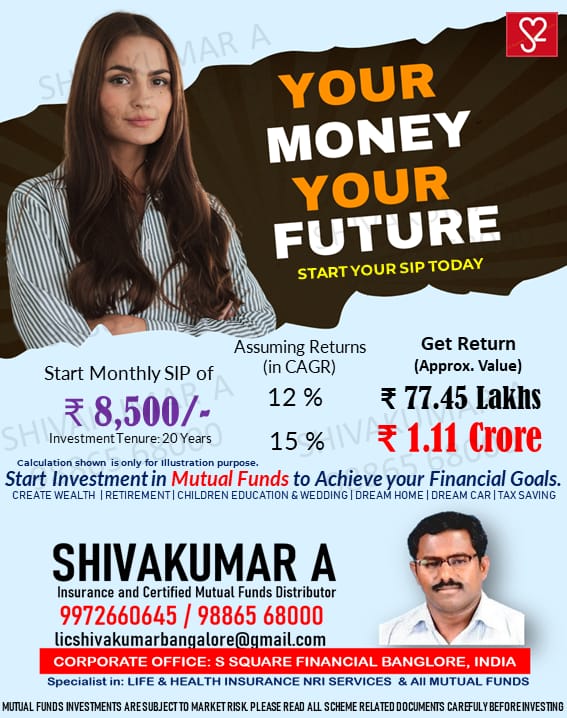

4. Goal-oriented Investing: SIPs are particularly suitable for achieving specific financial goals such as buying a house, funding education, or building retirement corpus. By aligning the SIP amount and duration with the target goal, investors can systematically accumulate wealth and achieve their objectives in a disciplined manner.

Starting a Mutual Funds SIP in Delhi

Starting a SIP in mutual funds in Delhi is straightforward and can be done through various channels:

1. Research and Selection: Begin by identifying your investment objectives, risk tolerance, and time horizon. Based on these factors, choose mutual funds that align with your financial goals—whether they are equity funds for long-term growth, debt funds for stability, or balanced funds for a mix of both.

2. Contacting a Distributor: To initiate a SIP, individuals can reach out to authorized distributors or agents who facilitate mutual fund investments. These distributors provide guidance on fund selection, assist with the application process, and ensure compliance with Know Your Customer (KYC) norms.

3. Direct Application with Fund Houses: Alternatively, investors can directly approach fund houses, where they can open an account and start a SIP online or through physical applications. Many fund houses offer user-friendly websites and mobile apps that streamline the process of investing and managing SIPs.

4. Customer Support: For personalized assistance and queries related to starting a SIP in mutual funds, individuals can contact customer support teams of respective fund houses or distributors. These teams are equipped to provide information on fund performance, investment strategies, tax implications, and any other concerns that investors may have.

Starting a SIP in mutual funds in Delhi offers individuals a convenient and effective means to build wealth over time while mitigating risks associated with market fluctuations. Whether you are a novice investor or seasoned in financial matters, SIPs provide a structured approach to achieving financial goals through disciplined investing. By leveraging professional management, diversification, and the flexibility of SIPs, residents of Delhi can embark on a path towards financial security and prosperity. To get started on your investment journey or for more information, reach out to us at 9886568000, and our team will be happy to assist you every step of the way.