SIP Shivakumar

SIP Shivakumar for Mutual Funds SIP

SIP Shivakumar for mutual fund investment in the ever-growing market.

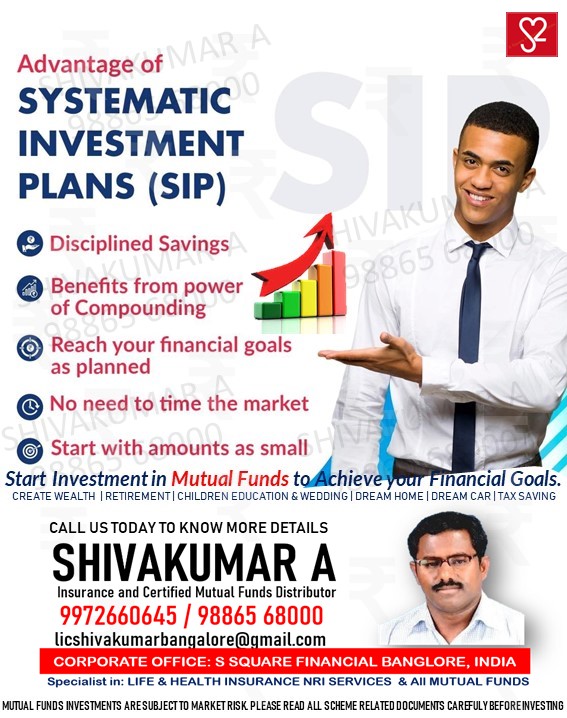

At SIP Shivakumar, we follow our passions, backed by expertise and experience. We started our journey of spreading financial awareness at all levels of society and making our clients’ lives safe, secure, and wealthy in 2011. During this long tenure, we expanded our bouquet of services, keeping in mind the client’s needs and benefits.

Start SIP in Mutual Funds and define goals like child education, a dream Car, a Dream Home, a Dream voyage, a happy retirement, etc. The advantage of SIP in Mutual funds is that it beats inflation. In a country where inflation and bank interest rates are the same, diversified investments in mutual funds and shares may only help the investor earn more than inflation.

Extensive and unbiased research before we recommend any product to our clients and best-in-class service are always our pillars of priority in everything we do.

- What is SIP?

- SIP stands for Systematic Investment Plan. It’s a method of investing in mutual fund schemes where an investor invests a fixed amount of money at regular intervals (typically monthly or quarterly) 1.

- SIPs allow individuals to invest in mutual funds in a disciplined manner, regardless of market fluctuations.

- Advantages of SIP in Mutual Funds:

- Beating Inflation: In a country where inflation and bank interest rates are similar, diversified investments like mutual funds may help investors earn more than inflation.

- Goal-Oriented Investing: Define goals such as child education, a dream car, a dream home, a dream voyage, or a happy retirement. SIPs help you work towards these objectives.

- Regular Investment: SIPs encourage regular investment, promoting financial discipline.

- Rupee Cost Averaging: By investing a fixed amount at regular intervals, you buy more units when prices are low and fewer units when prices are high, averaging out the cost.

- Types of SIPs:

- Equity SIP: Invest in equity mutual funds. Suitable for long-term wealth creation.

- Debt SIP: Invest in debt mutual funds. Ideal for capital preservation and regular income.

- Balanced SIP: Combine equity and debt components for balanced returns.

- Top-Up SIP: Increase your SIP amount periodically.

- Perpetual SIP: Continue SIPs indefinitely without an end date.

- Flexible SIP: Allows varying investment amounts based on market conditions.

- Trigger SIP: Invest based on market triggers (e.g., index levels).

If you need more details, feel free to explore additional resources on ET Money23. Happy investing! 🌟💰

To start a SIP, call 9886568000

Start SIP in Mutual Funds now, call 9886568000

Mutual funds sip or lump sum investments done, if the investor sells after 1 year from purchase date, long term capital gain tax will be applicable. From Tuesday, July 23, 2024, tax rate is 12.5%, if your total long term capital gain exceeds 1.25 lakh. The LTCG tax rate was hiked to 12.5 percent from 10 percent on all financial and non-financial assets. Any cess/surcharge is not included. If sold before 1 year from purchase date, short term capital gain tax will be applicable. Current tax rate is 20%. Any cess/surcharge is not included in the 20%.