Start Mutual Funds SIP* for the best returns

Start Mutual Funds SIP today, WhatsApp or by calling 9886568000

What are Mutual Funds SIP Services?

Systematic Investment Plans (SIPs) are a popular method of investing in mutual funds. They allow investors to invest a fixed amount regularly, typically monthly, into a chosen mutual fund scheme. This method of investment helps in averaging out the cost of purchase and instills financial discipline among investors.

Benefits of Starting a Mutual Funds SIP

- Disciplined Savings: SIPs encourage regular saving habits as they require consistent investments over a period.

- Rupee Cost Averaging: Since investments are made regularly, investors buy more units when prices are low and fewer units when prices are high, thus averaging out the purchase cost.

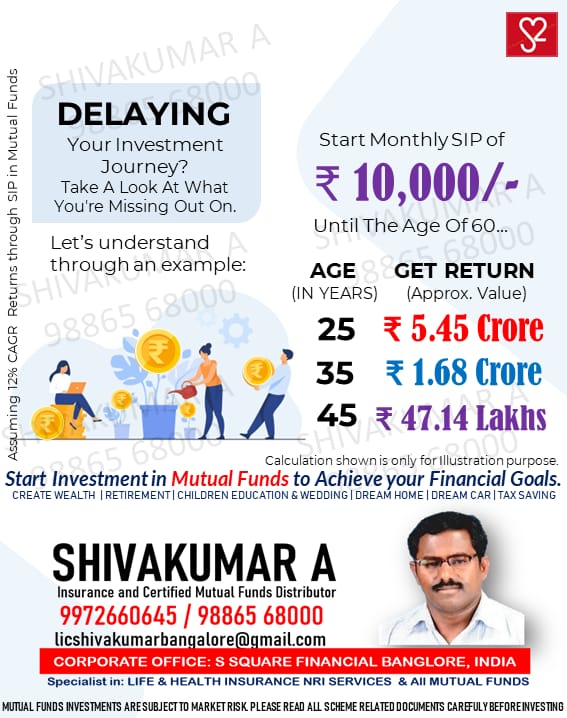

- Power of Compounding: Regular investments over time accumulate returns on both the principal and the returns generated, maximizing wealth through compounding.

- Flexibility: Investors can start, stop, or modify their SIPs as per their convenience without any penalties.

- Affordability: SIPs allow investments with as low as ₹500 per month, making them accessible to a broader audience.

Steps to Start a Mutual Funds SIP

- Define Investment Goals: Determine your financial goals, whether they are short-term or long-term, like buying a house, child’s education, or retirement.

- Choose the Right Fund: Based on your risk appetite and goals, choose an appropriate mutual fund. Equity funds are suited for long-term growth, while debt funds are safer for short-term needs.

- KYC Compliance: Complete the Know Your Customer (KYC) process, which is mandatory for mutual fund investments in India. This can be done online or offline.

- Register for SIP: You can register for SIP through the fund house’s website, a financial advisor, or various online platforms. Fill in the required details and set up a SIP mandate with your bank.

- Track and Review: Regularly monitor the performance of your SIP and make adjustments if necessary to stay aligned with your financial goals.

Starting a Systematic Withdrawal Plan (SWP)

Systematic Withdrawal Plans (SWPs) allow investors to withdraw a fixed amount from their mutual fund investments at regular intervals. SWPs are an excellent option for generating a steady income post-retirement.

- Select the Fund: Choose a mutual fund scheme that aligns with your income requirements and risk profile.

- Set Up SWP: Register for SWP with the fund house by specifying the withdrawal amount, frequency, and start date.

- Regular Income: SWP provides a regular income stream, ideal for retirees or those seeking periodic cash flows from their investments.

- Tax Efficiency: SWP can be more tax-efficient than withdrawing a lump sum, as the capital gains tax is applicable only on the withdrawn amount.

Best Mutual Funds for Retirement Savings

- Equity-Oriented Funds: Suitable for long-term growth, these funds invest primarily in equities. Examples include large-cap, mid-cap, and multi-cap funds.

- Hybrid Funds: These funds invest in a mix of equities and debt, balancing growth with stability. Examples include balanced advantage funds and aggressive hybrid funds.

- Debt Funds: Suitable for conservative investors, these funds invest in fixed-income securities. Examples include liquid funds, short-term funds, and corporate bond funds.

- Retirement-Focused Funds: Some funds are specifically designed for retirement planning, offering a mix of growth and safety.

Risks in Mutual Fund Investments

- Market Risk: The value of mutual fund investments can fluctuate due to market volatility.

- Credit Risk: The risk of default by the issuers of the securities in which the fund invests.

- Interest Rate Risk: Fluctuations in interest rates can affect the returns of debt funds.

- Liquidity Risk: The risk that the fund may not be able to sell its investments quickly at a fair price.

Best Mutual Funds for 2024

While it is challenging to predict the best funds for any given year, some categories typically recommended include:

- Large-Cap Funds: For stability and moderate growth.

- Mid-Cap Funds: For higher growth potential but with more risk.

- Balanced Funds: For a mix of growth and income.

How to Start SIP in Mutual Funds

- Online Platforms: Use online platforms or mobile apps like the fund house’s official site.

- Through Advisors: Seek help from financial advisors for tailored advice and setup.

- Directly with Fund Houses: Visit the fund house’s website and complete the SIP registration process.

Investments in mutual funds through SIPs are subject to market risks. It is crucial to read all scheme-related documents carefully before investing. If you need assistance or have any queries, feel free to contact Shivakumar at 948024013 for expert guidance on starting your mutual fund investments.

By leveraging SIPs, investors can systematically and consistently build wealth over time, beat inflation, and secure their financial future through disciplined investing.