Understanding SIPs

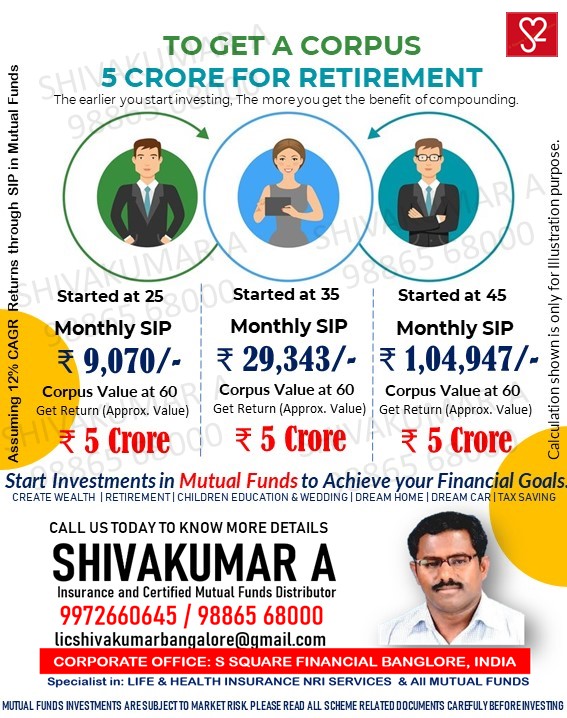

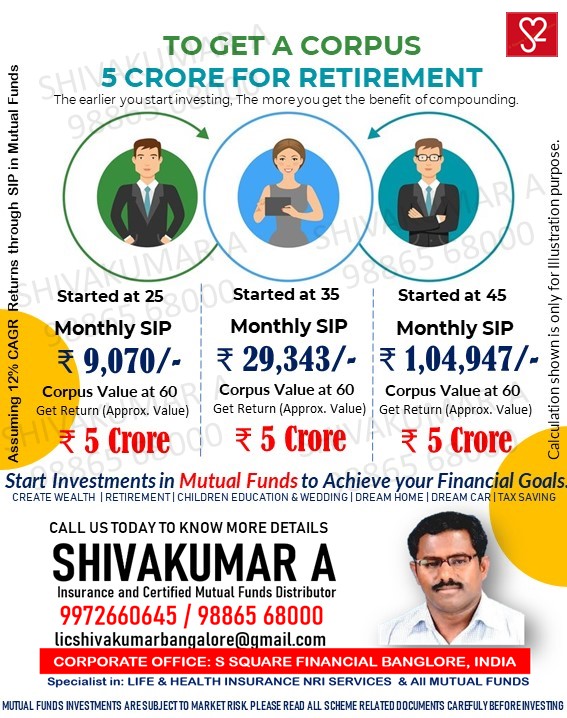

SIPs allow investors to invest a fixed amount in a mutual fund scheme at regular intervals (daily, weekly, monthly, etc.). This disciplined approach not only fosters a habit of regular savings but also helps in spreading out the investment over time, thereby reducing the risk of entering the market at the wrong time.

Rupee Cost Averaging

Both daily and monthly SIPs leverage the principle of rupee cost averaging, which means investing a fixed amount regularly regardless of the market condition. This strategy enables investors to buy more units when prices are low and fewer units when prices are high, which can lead to potentially higher returns over the long term compared to making a lump-sum investment.

The Case for Monthly SIPs

- Convenience: Monthly SIPs align with most people’s income schedules, as salaries are typically paid monthly. This makes it easier to set aside a portion of the income towards investments systematically.

- Lower Transaction Costs: Depending on the platform or fund house, each SIP installment might incur transaction charges. Monthly SIPs result in fewer transactions compared to daily SIPs, potentially saving on transaction costs.

- Compounding Benefit: While the compounding effect works in both cases, the administrative ease of managing monthly SIPs often means that investors stick with their plans longer, thus harnessing the power of compounding more effectively.

The Case for Daily SIPs

- Market Volatility: Daily SIPs allow investors to capitalize more granularly on market volatility. By investing every day, you are spreading your investment across various market levels more finely than with monthly investments.

- Potential for Slightly Higher Returns: In theory, because daily SIPs spread the investment more evenly across market conditions, they might capture market lows more effectively than monthly SIPs. However, the difference in long-term returns might be marginal and heavily influenced by market conditions throughout the investment period.

Which Offers More Returns?

The debate between monthly and daily SIPs often boils down to marginal differences in returns, significantly influenced by broader market performance. For most retail investors, the convenience and manageability of monthly SIPs make them the preferred choice. The potential difference in returns is often not substantial enough to justify the increased complexity and transaction costs associated with daily SIPs.

Furthermore, investing is a long-term journey. Factors such as the choice of fund, investment horizon, and overall market conditions play a much more significant role in determining your investment’s success than the SIP frequency.

Conclusion

Ultimately, the best SIP frequency depends on an investor’s personal preferences, financial goals, and investment strategy. For most, monthly SIPs offer a practical and efficient way to invest in mutual funds, aligning well with regular income patterns and ensuring a disciplined investment approach. Daily SIPs, while an interesting concept, may add complexity without proportionately increasing returns for the average investor.

Investors should focus more on choosing the right mutual funds based on their investment goals, risk tolerance, and time horizon, and maintaining a disciplined approach to investing, rather than getting overly concerned with the frequency of their SIP investments. Consulting with a financial advisor can also provide personalized insights and help tailor an investment strategy that best suits one’s financial objectives.

Start SIP, call 9886568000