Mutual funds in India

Click to start Mutual Funds now

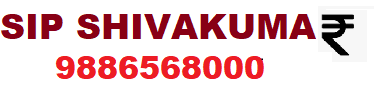

Mutual funds in India have become very popular as a safe and adaptable investment option. Whether you are starting your professional life or want to plan your retirement, mutual funds have something for everyone. Mutual fund investments need proper advice to invest in the volatile market. Proper market advice on rebalancing on the basis of the investor’s age may help the investor save his investments in the unguaranteed market. If you are looking to invest or want to know more about it, you can reach Shivakumar A on 9886568000 for custom advice.

Why India Mutual Funds Are a Good Option

Mutual funds collect funds from different investors and invest these funds in diversified stocks, bonds, or securities. They are managed by fund managers who follow a strategy of maximizing returns at the lowest risks.

Here is why they prove to be the best option for Indian investors:

Diversification: Invests in multiple assets, thus limiting risk.

Professional Management: Sophisticated fund managers make key investment decisions.

Liquidity: Simple to buy and sell, providing flexibility to the investor.

Affordability: Invest from as little as ₹1000 through SIPs (Systematic Investment Plans).

Start Mutual Funds in India at Any Age Mutual funds are one of the best benefits, which can be availed of by people of any age group:

1. Young Investors (20s to 30s)

This is the best age to invest and grow the most. Equity mutual funds are suitable because they can offer high returns. Early investment also helps you reap the benefit of compounding.

2. Mid-Career Investors (30s to 40s)

At this point, you might have several financial obligations, such as children’s education and home loans. Balanced funds or hybrid mutual funds offer a combination of growth and stability in accordance with medium- to long-term financial objectives.

3. Pre-Retirement (50s and above)

As you get closer to retirement, it is advisable to move towards conservative investments. Debt mutual funds and monthly income plans can deliver stability and regular income with reduced risk.

How to Begin Mutual Funds in India

Beginning your investment journey has never been simpler:

Discover Your Investment Aims: Understand why you are investing—retirement, education for your kids, or creating wealth.

Select the appropriate mutual fund: Pick a fund according to your risk appetite and tenure.

Fill KYC: Complete the Know Your Customer (KYC) process for verification.

Begin Investing: Start with a lump sum or choose a SIP for systematic investment.

If you’re unsure where to begin, contact Shivakumar A at 9886568000 for expert advice on choosing the right mutual fund according to your financial goals.

Why Contact Shivakumar A?

With vast experience in the financial sector, Shivakumar A can help you:

Understand the different types of mutual funds. Choose funds that align with your investment goals and risk tolerance. Start a SIP or make a lump-sum investment with ease.

In Investing in mutual funds can be one of the excellent options for increasing wealth, provided with proper counseling. Contact us on 9886568000 now and plan your investment career.

Secure Your Future with Mutual Funds

Indian mutual funds provide a painless and simple method of generating wealth. Either you are young or old in investment experience, there is a mutual fund specific to your need. Invest now, invest carefully, and witness your money grow big. For information and investment solutions specifically tailored, call Shivakumar A on 9886568000.

Buy Health Insurance from Experienced Advisors Only

When purchasing health insurance, it’s crucial to consult with advisors who have 15 to 20 years of experience. These experts understand the complexities of policies, exclusions, and claim processes, ensuring you get the right coverage without hidden surprises. Unlike online platforms that lure buyers with discounts, experienced advisors provide personalized guidance tailored to your needs. They help you avoid common pitfalls and select a policy that truly protects you and your family. Never buy health insurance online just for discounts—prioritize expert advice for a secure future.

Insure and invest today and ensure that you have the money you’ll need tomorrow.