Invest in Gold and Silver Funds

A Smart Choice for Good Returns

Gold and silver have long been considered safe-haven assets, offering stability and value preservation during economic uncertainties. In recent years, gold and silver funds have emerged as popular investment options, providing investors with an opportunity to benefit from the price appreciation of these precious metals without the need for physical ownership. With a history of delivering good returns, these funds are an attractive addition to any diversified investment portfolio. This article explores the benefits of investing in gold and silver funds, analyzes their past performance, and answers common questions to help you make informed decisions.

Invest in Gold and Silver funds; returns are subject to market conditions

Why invest in Gold and Silver Funds?

- Inflation Hedge: Gold and silver have historically maintained their value during inflationary periods, making them a reliable hedge against rising prices.

- Diversification: Adding gold and silver funds to your portfolio reduces risk by diversifying across asset classes.

- Liquidity: These funds are highly liquid, allowing you to buy or sell units easily compared to physical gold and silver.

- No Storage Hassles: Unlike physical metals, gold and silver funds eliminate the need for secure storage and insurance.

- Strong Past Performance: Both gold and silver have shown consistent growth over the years, making them a trusted investment option.

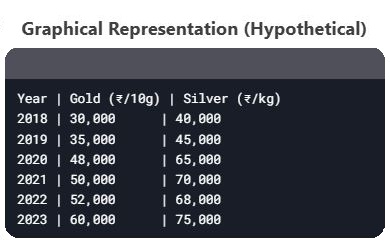

Past Performance of Gold and Silver Funds

Gold and silver funds have delivered impressive returns over the past decade. For instance:

- Gold Funds: Between 2010 and 2020, gold prices in India surged from approximately ₹18,000 per 10 grams to over ₹50,000, reflecting an annualized return of around 10-12%.

- Silver Funds: Silver, though more volatile, has also shown significant growth. From 2010 to 2020, silver prices rose from ₹30,000 per kilogram to nearly ₹70,000, offering substantial returns during certain periods.

Q1: What are gold and silver funds?

A: Gold and silver funds are mutual funds or exchange-traded funds (ETFs) that invest in physical gold, silver, or related financial instruments. They allow investors to gain exposure to these metals without owning them physically.

Q2: How do gold and silver funds work?

A: These funds pool money from multiple investors to buy gold, silver, or derivatives. The fund’s value fluctuates based on the market prices of these metals.

Q3: Are gold and silver funds safe?

A: While they are relatively safe, their prices can be volatile in the short term. However, they are considered a stable long-term investment.

Q4: What is the minimum investment amount?

A: The minimum investment varies by fund but typically starts as low as ₹500 for SIPs or ₹1,000 for lump-sum investments.

Q5: How are returns taxed?

A: Returns from gold and silver funds are taxed as capital gains. Short-term gains (held for less than 3 years) are taxed at your income tax slab rate, while long-term gains (held for more than 3 years) are taxed at 20% with indexation benefits.

Returns are subject to volatility; read the offer document before investing

Investing in gold and silver funds is a prudent choice for those seeking stability, diversification, and good returns. With their strong historical performance and ease of investment, these funds offer a convenient way to capitalize on the enduring value of precious metals. Whether you’re a seasoned investor or a beginner, gold and silver funds can enhance your portfolio’s resilience and growth potential. Always conduct thorough research or consult a financial advisor to align your investments with your financial goals. Start exploring gold and silver funds today and secure your financial future!

Invest in Gold and Silver funds; call: 9886568000

Returns are subject to market conditions