View and Track All Your Mutual Fund Investments in One Place at one click

View and track all your mutual fund investments in one place; no need to worry about your mutual funds investments now onwards. Investing in mutual funds has become a popular choice for individuals aiming to grow their wealth systematically over time. However, managing multiple investments across various funds and platforms can sometimes be challenging. This is where the ability to view and track all your mutual fund investments in one place proves invaluable. By consolidating your investments, you can make informed decisions, optimize your portfolio, and achieve financial goals with greater ease.

Importance of Consolidated Tracking

Tracking all your mutual fund investments under one roof offers several advantages. First, it provides a holistic view of your portfolio, enabling you to monitor its performance across different asset classes, such as equity, debt, or hybrid funds. This visibility helps you assess whether your investments align with your risk appetite and financial objectives.

Second, centralized tracking reduces the complexity of managing investments spread across multiple fund houses or platforms. With a unified view, you can easily evaluate your returns, assess diversification, and rebalance your portfolio when necessary.

Lastly, having all your investments in one place enhances transparency. It eliminates the risk of overlooking underperforming funds and ensures you are up-to-date with market trends and fund performance, making your investment journey smooth and efficient.

Role of Mutual Funds Distributors (MFD)

Mutual Fund Distributors for Comprehensive Services

Mutual fund distributors play a pivotal role in assisting investors throughout their investment journey. These professionals or platforms are authorized intermediaries who facilitate buying, selling, and managing mutual funds.

Whether you are a first-time investor or a seasoned one, mutual fund distributors provide a range of services, including:

- Portfolio Analysis: Offering insights into your portfolio’s performance and suggesting adjustments based on market trends.

- Fund Selection: Recommending funds that suit your financial goals, risk tolerance, and investment horizon.

- Transaction Assistance: Helping you execute buy, sell, or switch transactions seamlessly, both online and offline.

- Customer Support: Providing assistance with documentation, KYC compliance, and resolving queries related to investments.

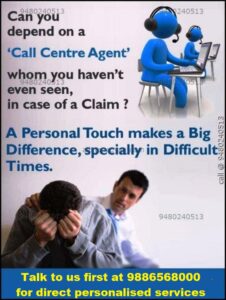

One of the key advantages of using a mutual fund distributor is their availability across both online and offline channels. For tech-savvy investors, online platforms offer the convenience of investing and tracking portfolios from the comfort of their homes. Meanwhile, offline services cater to those who prefer personalized guidance and face-to-face interactions.

Be Cautious: Avoid Unknown Online Apps

In the digital age, numerous online platforms promise easy investment options in mutual funds. While many are legitimate and regulated, there has also been a rise in fraudulent apps and services targeting unsuspecting investors. It is crucial to exercise caution and never invest through unknown online apps without thoroughly verifying their credentials.

Before entrusting your hard-earned money to an online app, consider the following steps:

- Verify Legitimacy: Check if the app is registered with the Securities and Exchange Board of India (SEBI) or a similar regulatory authority in your country.

- Read Reviews: Look for reviews and ratings on trusted platforms to gauge the app’s reputation and reliability.

- Check Transparency: Ensure the platform provides clear details about fees, commissions, and fund recommendations.

- Avoid Upfront Payments: Be cautious of apps asking for high upfront payments or promising unrealistic returns.

- Stick to Trusted Platforms: Use apps offered by reputed financial institutions, AMCs (Asset Management Companies).

The Benefits of Trusted Platforms and Services

Using trusted platforms or authorized mutual fund distributors ensures your investments are secure and compliant with regulations. These platforms often provide additional tools, such as goal-based planning, tax-saving calculators, and real-time portfolio analysis, to enhance your investment experience.

Additionally, a trusted service provider offers peace of mind. You can focus on achieving your financial goals without worrying about the safety or authenticity of your investments.

We suggest our clients have one app for all investments and reduce the burden on remembering user id and passwords. Managing mutual fund investments doesn’t have to be a daunting task. By consolidating your portfolio into a single platform, utilizing the services of reliable mutual fund distributors, and avoiding unknown apps, you can streamline your investment journey. Make informed decisions, stay vigilant, and choose trusted platforms to ensure your investments work effectively towards building a secure financial future.