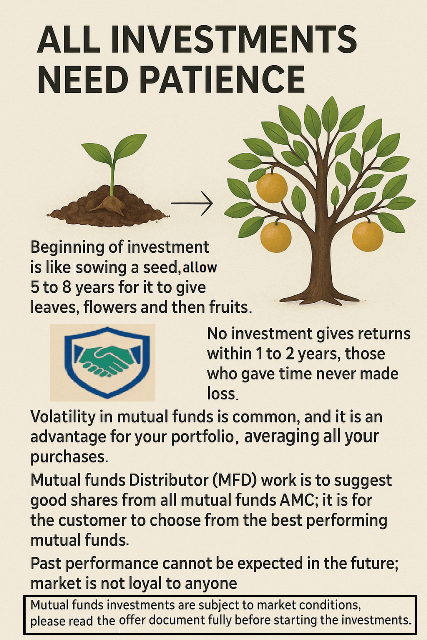

All Investments Need Patience

Just Like Sowing a Seed

Investing is a lot like farming. You sow a seed today, water it regularly, provide sunlight and care, and then patiently wait as it grows into a plant, bearing leaves, flowers, and eventually, fruits. But this journey doesn’t happen overnight. In fact, it can take anywhere between 5 and 8 years for an investment to fully flourish, depending on the nature and goals of the investment. Similarly, the beginning of any financial investment, especially in mutual funds, demands the same level of patience and nurturing.

No investment gives meaningful returns in just 1 or 2 years. In the short term, markets may fluctuate, returns may be inconsistent, and emotions may get tested. But that doesn’t mean the investment has failed. Just like you don’t dig up a seed every few days to check if it’s growing, investments too need to be left undisturbed with a long-term view. Historical evidence and countless success stories confirm that those who gave time to their investments never made a loss in the long run.

Understanding Volatility: A Hidden Advantage

Volatility in mutual funds is completely normal and, contrary to common belief, it is actually beneficial for your portfolio. When you invest regularly over time, especially through SIPs (Systematic Investment Plans), the fluctuations in the market allow you to buy more units when the market is low and fewer when it is high. This averaging process, known as rupee cost averaging, reduces the overall cost of your investments and positions your portfolio to benefit when the market rises again.

Think of volatility as seasons in your investment journey. Some seasons bring rain, some bring sunshine. But each plays its part in nurturing the seed you planted. So instead of fearing market ups and downs, an informed investor sees it as an opportunity to accumulate more units and stay on course.

Role of a Mutual Fund Distributor (MFD)

A Mutual Fund Distributor (MFD) acts as a guide in your investment journey. The MFD’s role is to evaluate and suggest the best-performing schemes across various AMCs (Asset Management Companies). They analyze different mutual funds based on performance, management, risk, and suitability to your financial goals. However, the final decision always rests with you—the investor.

It is essential to note that past performance of a mutual fund should not be the only factor in choosing it. Markets are dynamic and not loyal to anyone. A fund that performed well in the last 3 or 5 years may not necessarily continue to do so. This is why diversification, regular reviews, and long-term commitment are crucial components of successful investing.

Investor Responsibility and Risk Awareness

Mutual fund investments come with their own set of risks. It is generally understood that mutual fund investors have a basic understanding of these market risks. Investments are subject to market conditions, and returns are neither fixed nor guaranteed. Therefore, it is important to read the scheme-related documents carefully before investing. These documents provide detailed insights into the fund’s objectives, investment strategy, risk factors, and past performance data.

Investing without understanding these aspects is like planting a seed without knowing what kind of tree it will grow into. Knowledge empowers investors to set realistic expectations and maintain discipline during turbulent market phases.

Summary

Investments are not a quick-fix solution for wealth creation. They require patience, understanding, and time—just like the journey of a seed growing into a fruit-bearing tree. Give your investments the time they deserve. Stay invested, stay informed, and stay calm through market cycles. Trust the process and let compounding work its magic over the years.

Remember, no one who gave time to their investments ever walked away disappointed.

The fruit is always worth the wait.