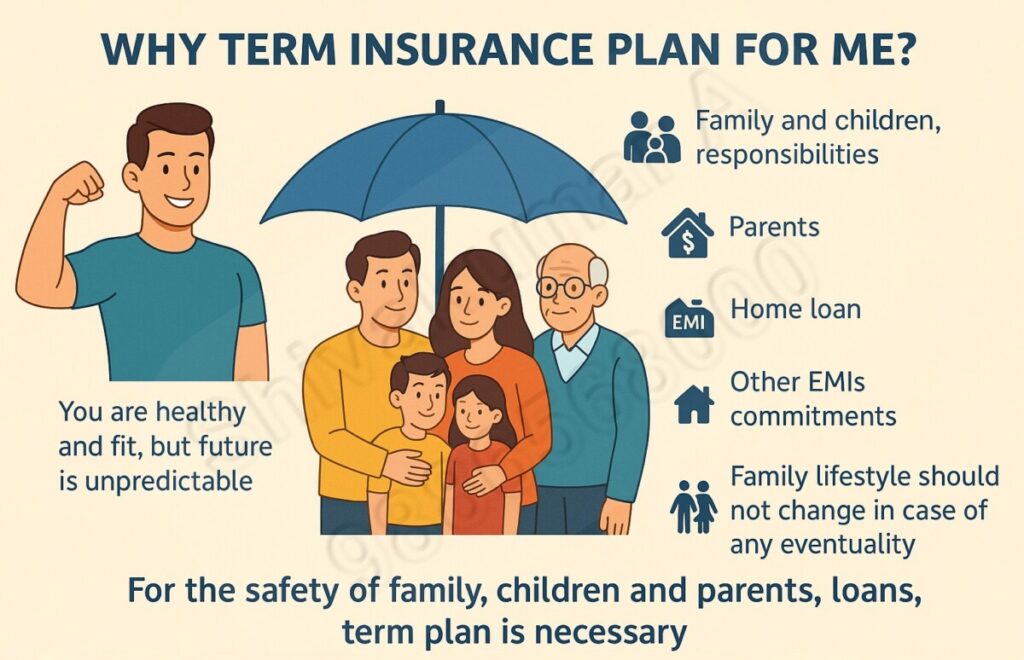

Why a Term Insurance Plan Is Important for me

I am healthy, fit, and leading a fairly disciplined lifestyle. I exercise regularly, eat well, and stay away from harmful habits. Yet, even with all of this, I know one simple truth: life is unpredictable. Accidents, critical illnesses, and unforeseen health complications can strike anyone, at any time. And while I can’t control the future, I can certainly prepare for it. That’s exactly why I believe a term insurance plan is essential for me.

My life is not just about me anymore. I have a loving family, young children with dreams and ambitions, and aging parents who depend on me emotionally and financially. I have taken up several responsibilities over the years — from supporting my household expenses to paying off a home loan, managing EMIs, and maintaining a lifestyle that my family is accustomed to. These aren’t just monthly numbers; they are commitments made to my family’s security and well-being.

In the event of an untimely death, I wouldn’t want my family to be burdened by the financial pressure of ongoing loans and lifestyle expenses. The idea that they might have to give up their current standard of living, withdraw from quality education, or be forced to sell the house to cover debts is deeply unsettling. That’s where a term insurance plan steps in as a safety net.

A term insurance plan provides a large sum assured at an affordable premium. It offers pure protection — no frills, no investment component — just financial security. If something were to happen to me, my family would receive a pre-decided lump sum payout that could help them cover living expenses, continue their lifestyle, pay off debts like home loans or personal loans, and secure the children’s education without compromise. This gives me peace of mind today, knowing I’ve done my part in planning for their future.

Many people delay buying term insurance because they feel young, invincible, or healthy. I was one of them. But over time, I’ve realized that health today doesn’t guarantee safety tomorrow. Insurance is best bought when you don’t need it — when you’re healthy and the premiums are low. Waiting until something goes wrong can either make it too expensive or impossible to get coverage.

Moreover, term insurance isn’t just about death coverage. Some plans also offer optional riders for critical illness, accidental disability, or waiver of premium, which enhance the protection. This means even if I were to survive but become incapable of earning, my policy would still support my family in the absence of income.

My family depends on me, and that dependence is not just emotional — it is financial. I do not want their dreams to die with me. A term insurance plan ensures that my absence does not translate into their financial suffering. It acts as a financial guardian, allowing my loved ones to continue their lives with dignity.

In today’s world, where inflation rises steadily and uncertainties have become a part of daily life, not having term insurance is a bigger risk than having one. For a small annual cost, I can create a massive financial shield around my family.

So yes, I may be healthy and optimistic about life, but I’m also realistic and responsible. A term insurance plan is not an expense — it’s an act of love, foresight, and responsibility. It’s my way of saying: “Even if I’m not around tomorrow, I’ve got you covered.”

FAQ on Term Insurance plans

Why is a term insurance plan important?

Term insurance ensures financial security for your loved ones in your absence. It offers high coverage at affordable premiums, providing peace of mind and income protection.

Is term insurance really necessary?

Yes, term insurance is essential for anyone with dependents. It safeguards your family’s future by replacing lost income, covering debts, and supporting lifestyle needs if something happens to you.

Is it worth having term life insurance?

Absolutely. Term life insurance offers significant coverage for a low cost, making it a smart financial safety net for families, especially during key life stages and responsibilities.

Can I buy online term insurance?

Yes, you can buy term insurance online—it’s quick, convenient, and often cost-effective. However, in case of a claim, online platforms or telecallers may not provide personalized support to your nominees. Choosing an experienced advisor ensures hands-on guidance, especially during crucial moments like claim settlement and beneficiary assistance.

How important is term insurance in India?

In India, term insurance is vital due to rising costs, family dependence on a single income, and minimal social security. It ensures financial continuity in case of untimely death.

What happens if you don’t use term life insurance?

If the policyholder survives the term, there’s no payout. However, the real value lies in the protection it offers during the policy period—not in maturity benefits.

What is the biggest advantage of term life insurance?

The biggest advantage is its affordability. Term insurance provides substantial coverage at low premiums, making it the most cost-effective way to financially protect your family.