Mutual Fund Bangalore

Bangalore, often called the Silicon Valley of India, is not only a tech hub but also a rapidly growing center for smart financial planning. With a younger workforce, rising disposable incomes, and a growing awareness of wealth management, mutual funds in Bangalore are becoming a popular investment avenue for individuals and families alike. Now you can fund all your insurance and investment need with mutual fund investments. It is easy to invest and monitor.

Start Mutual fund, call: 9886568000

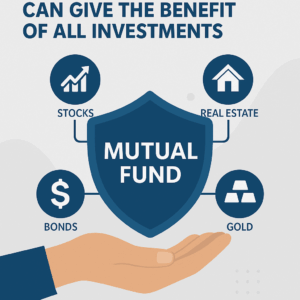

Among the various types of mutual funds available today, one particularly appealing concept for modern investors is a “one mutual fund with all-in-one benefits”—a fund that offers multiple advantages similar to an insurance policy, but without the need for a life cover. These types of mutual funds are ideal for those looking to consolidate their financial planning into a single product that addresses various financial needs like health, accident protection, critical illness cover, tax benefits, and capital growth.

The Bangalore Investor Mindset

Investors in Bangalore are typically tech-savvy, well-informed, and prefer convenience without compromising on returns. Whether they are salaried employees in MNCs, start-up founders, or freelancers, there is a growing interest in financial products that can offer:

-

Long-term wealth creation

-

Health-related protection

-

Tax-saving opportunities

-

Hassle-free digital transactions

-

Transparent and regulated frameworks

Mutual funds check all these boxes, especially when paired with value-added insurance-like features.

Why This Matters to Bangalore Investors

Given the fast-paced and unpredictable nature of careers in Bangalore—from tech startups to gig economy roles—having a multipurpose mutual fund offers a safety net without the complexity of juggling multiple policies.

Here’s why it’s a hit in Bangalore:

-

Time-saving: One fund, multiple benefits

-

Tech-enabled: Easy to track, invest, and redeem online

-

Flexible: Adjust SIP amounts or exit partially, unlike rigid insurance plans

-

Goal-based investing: Aligns with milestones like medical emergencies, education, or home down payments

Please note

If you’re based in Bangalore and seeking a financial solution that offers the investment potential of mutual funds combined with the protection and perks of insurance policies (except life cover), these all-in-one mutual fund solutions are worth exploring. Speak to a trusted mutual fund distributor or financial advisor in Bangalore to identify the most suitable option for your risk appetite and future goals.

These hybrid mutual fund products represent the future of smart investing—simplified, secure, and strategically designed for the new-age investor.