HDFC MUTUAL FUND DISTRIBUTOR NEAR ME

Start Your Investment Journey with an HDFC Mutual Fund Distributor Near You

In today’s financial landscape, simply keeping money in a savings account is not enough to build wealth or even beat inflation. With rising costs and future financial goals, it’s essential to make your money work harder for you. One of the most accessible and effective ways to do that is by investing in mutual funds. If you’re looking to begin this journey, finding an HDFC Mutual Fund distributor near you is a great first step.

Why Choose HDFC Mutual Funds?

HDFC Mutual Fund is one of the most trusted and established fund houses in India. With a track record of consistent performance, a wide range of investment options, and strong fund management, HDFC offers schemes suitable for every type of investor—whether you’re a first-time investor or someone with years of experience in the market.

By connecting with a local HDFC mutual fund distributor, you get expert guidance, help with documentation, KYC assistance, and personalized investment planning tailored to your goals.

Start a Mutual Fund SIP: A Disciplined Approach

A Systematic Investment Plan (SIP) is an easy and smart way to invest regularly in mutual funds. It allows you to invest a fixed amount every month, bringing discipline and long-term focus to your financial planning. SIPs help you benefit from rupee cost averaging and the power of compounding.

Whether your goal is wealth creation, buying a house, your child’s education, or planning for retirement, SIPs in HDFC Mutual Funds can help you get there without needing a large upfront investment.

Here are the top 5 HDFC Mutual Fund schemes based on their 10-year annualized returns as of March 31, 2025:

HDFC Mid-Cap Opportunities Fund

-

10-Year CAGR: 18.91%

-

Ideal for: Investors seeking high growth through mid-cap companies.

-

Highlights:

-

Focuses on mid-sized companies with significant growth potential.

-

Suitable for long-term investors with a higher risk tolerance.

-

-

10-Year CAGR: 16.5%

-

Ideal for: Investors comfortable with a concentrated portfolio aiming for higher returns.

-

Highlights:

-

Invests in a maximum of 30 high-conviction stocks.

-

Focused approach may lead to higher volatility but potential for superior returns.

-

HDFC Large and Mid Cap Fund

-

10-Year CAGR: 16.12%

-

Ideal for: Investors seeking a blend of stability and growth.

-

Highlights:

-

Combines investments in large-cap and mid-cap companies.

-

Aims to balance risk and return effectively.

-

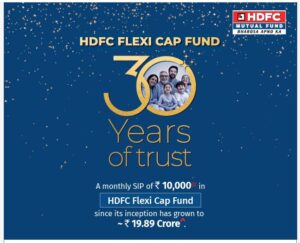

HDFC Flexi Cap Fund

-

10-Year CAGR: 16.82%

-

Ideal for: Investors seeking flexibility across market capitalizations.

-

Highlights:

-

Invests across large-cap, mid-cap, and small-cap stocks.

-

Adaptable to changing market conditions.

-

HDFC Small Cap Fund

-

10-Year CAGR: 21.20%

-

Ideal for: Aggressive investors seeking high growth potential through investments in small-cap companies.

-

Highlights:

-

Focuses on emerging businesses with significant growth prospects.

-

Suitable for investors with a long-term horizon and higher risk tolerance.

-

Note: The above returns are based on data available as of March 31, 2025, and are subject to market risks. In Mutual funds, past performance does not guarantee future results.

Thanks to ChatGPT for this article

Debt Funds: Better Returns Than a Savings Account

Many people let their money sit idle in a savings account, earning just 2.5%–3.5% annually. Debt mutual funds, on the other hand, offer better returns and are relatively low-risk, especially when compared to equity investments.

Debt funds invest in instruments like government securities, corporate bonds, and money market instruments. Some popular options in HDFC Mutual Funds include:

-

-

HDFC Corporate Bond Fund

-

HDFC Short Term Debt Fund

-

HDFC Liquid Fund

-

These are ideal for conservative investors or those looking to park surplus funds with better returns and reasonable safety.

Use SWP and STP to Manage Your Money Smartly

HDFC Mutual Funds also allow you to make use of investment tools like Systematic Withdrawal Plan (SWP) and Systematic Transfer Plan (STP).

-

SWP: Ideal for retirees or anyone needing regular income. You can withdraw a fixed amount every month from your investment while the rest continues to grow.

-

STP: Helps you reduce market timing risks by transferring money gradually from one fund to another. For example, you can transfer from a debt fund to an equity fund over time, reducing exposure to volatility.

Plan Your Retirement with HDFC Pension Plans

HDFC also offers retirement-oriented mutual fund schemes and pension plans designed to build a corpus for your post-retirement life. These long-term plans help you accumulate wealth gradually and ensure you have financial independence even after you stop working.

Investing in a pension plan via SIP gives you the dual benefit of disciplined saving and long-term capital appreciation.

Beat Inflation with Smart Investment

Inflation silently erodes the value of your money over time. For example, something that costs ₹100 today may cost ₹150 in a few years. Keeping money idle in savings accounts won’t help you stay ahead of this curve. Mutual fund investments, particularly equity-oriented and hybrid funds, can help generate inflation-beating returns over the long term.

By consulting an HDFC Mutual Fund distributor, you can choose a diversified portfolio that matches your risk appetite and financial goals.

Why HDFC MUTUAL FUND DISTRIBUTOR NEAR ME

Whether you’re a beginner or an experienced investor, it’s never too late to start planning for your future. By partnering with an HDFC Mutual Fund distributor near you, you gain access to expert advice, trusted schemes, and flexible investment options tailored for every stage of life. From SIPs and debt funds to SWP, STP, and pension plans—HDFC Mutual Funds offer you all the tools you need to grow your wealth smartly and securely.