How to Start Mutual funds SIP and SWP

Mutual fund sip is growing day by day. Today, people are most interested in mutual funds SIP rather than any other investments. Everyone is more interested in mutual funds with term insurance than endowment plans. The change in customer behavior is due to market upside and inflation.

Inflation in the country may eat out 6 to 8 percent returns from the endowment life insurance plans present in the market. Mutual fund investments, although risk is there, over a period of time it may appreciate considering the past performance.

There is risk everywhere; without risk, you may get the required results. There are many mutual funds which had given more than 20% returns over the last 5 years, which means the investment has doubled in the last 5 years.

Investing in mutual funds has become one of the most popular and accessible ways to build wealth over time. Two of the most effective ways to structure mutual fund investments are through systematic investment plans (SIP) and systematic withdrawal plans (SWP). Both of these plans provide flexibility, discipline, and convenience, making them suitable for investors with different goals. Let’s explore how to start a SIP and SWP and how these plans can be beneficial for your financial journey.

1. How to Start a SIP (Systematic Investment Plan)

A systematic investment plan (SIP) allows you to invest a fixed amount of money in a mutual fund at regular intervals, typically monthly or quarterly. SIPs are particularly popular among long-term investors due to their potential for building wealth through compounding and rupee cost averaging.

Steps to start an SIP:

- Choose the Right Mutual Fund:

- Identify Your Financial Goals: First, determine your investment objective. Are you investing for retirement, your child’s education, or a down payment on a house? Your goals will dictate the type of mutual fund you should choose (e.g., equity funds for long-term growth or debt funds for stability).

- Risk Profile: Understand your risk tolerance. Equity mutual funds are riskier but have the potential for higher returns over the long term, while debt funds are safer with more stable returns.

- Research Funds: You can use mutual fund ratings, performance history, and fund manager experience to choose the right fund. It’s also important to check the fund’s expense ratio and performance over a longer period (at least 3–5 years).

- Decide on the amount and frequency:

- Fixed Investment Amount: Determine how much money you want to invest regularly. SIPs typically start with amounts as low as ₹ 1000 per month, making them accessible to a wide range of investors.

- Frequency: Decide how often you want to contribute. Monthly SIPs are the most common, but you can also opt for quarterly SIPs if it better aligns with your income cycle.

- Complete Your KYC (Know Your Customer):

- Document Submission: Before you can invest in any mutual fund, you need to complete the KYC process. This involves submitting your identity proof, address proof, and photographs. Most mutual fund distributors and online platforms have an easy-to-complete KYC process, which can even be done digitally.

- eKYC: For convenience, many mutual fund houses allow eKYC, where you can complete the process online through your Aadhaar number, PAN card, and a selfie.

- Link Your Bank Account:

- Automatic Payments: You’ll need to link your bank account to the SIP. This allows for automatic deductions of the SIP amount each month on a specific date. Ensure that your account has enough balance to avoid missed payments.

- Track and Review:

- Monitor Your SIP: SIPs are long-term investments, so you don’t need to track them daily. However, it’s important to review the performance of your chosen fund periodically (quarterly or annually) and adjust your investments if needed.

- Rebalance if Necessary: If your goals or risk appetite change, you may want to increase or decrease your SIP amount or switch to a different fund.

Benefits of SIP:

- Rupee Cost Averaging: SIPs help smooth out the volatility in the market. By investing a fixed amount regularly, you buy more units when prices are low and fewer units when prices are high.

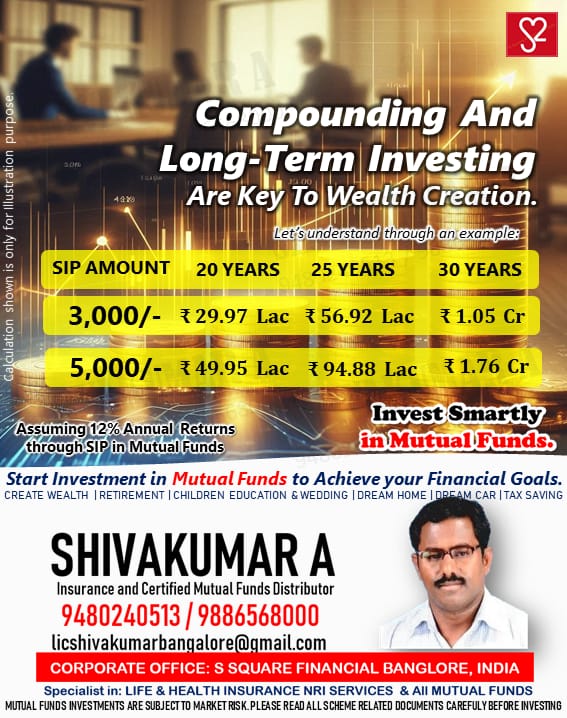

- Compounding: The earlier you start SIPs, the greater the potential for compounding to work in your favor, especially in equity funds.

2. How to Start an SWP (Systematic Withdrawal Plan)

A Systematic Withdrawal Plan (SWP) allows investors to withdraw a fixed amount from their mutual fund investments periodically, such as monthly, quarterly, or annually. SWP is especially useful for those who require a steady cash flow, such as retirees or individuals with other income needs.

How to Start Mutual funds SIP and SWP online

Choose the Right Mutual Fund:

-

- Just like SIP, the first step in starting an SWP is selecting the right mutual fund. However, SWP is typically used with funds that have built up over time, especially equity or hybrid funds that have generated substantial capital appreciation.

- You should choose a fund that offers the stability needed for consistent withdrawals. Ideally, the fund should have performed well over the long term to ensure that your withdrawals don’t erode your principal prematurely.

Decide on the amount and frequency:

-

- Withdrawal Amount: You need to determine the amount you want to withdraw regularly. It should be sufficient for your income needs but should not drain the principal too quickly.

- Withdrawal Frequency: You can choose the frequency of your withdrawals—monthly, quarterly, or annually. Monthly SWPs are most common for retirees or those who need regular income.

Complete Your KYC (Know Your Customer):

-

- SWP, like SIP, requires a completed KYC process before you can set up the withdrawals. If you’ve already invested in a mutual fund, your KYC should already be completed.

Set Up the SWP:

-

- Choose Withdrawal Mode: You can set up your SWP either through your mutual fund distributor or directly on the fund’s website or through an online investment platform.

- Link Your Bank Account: To receive the withdrawal amount, you need to link your bank account for seamless transfers.

Monitor Your Withdrawals:

-

- Track Fund Performance: Since SWPs deplete the capital in your fund over time, it’s important to track the performance of your fund to ensure it continues to meet your income needs without running out of principal too quickly.

- Adjust withdrawals if needed: If the value of your fund drops due to market conditions, you may need to adjust your withdrawal amounts to ensure your fund doesn’t get depleted too quickly.

Benefits of SWP:

- Regular Income: SWPs provide a regular stream of income, making them ideal for retirees, people with regular financial obligations, or anyone looking to supplement their income.

- Tax Efficiency: Long-term capital gains from equity mutual funds are subject to lower tax rates, making SWPs more tax-efficient when executed from funds that have held investments for more than a year.

Both SIP and SWP are powerful tools that cater to different financial needs. SIP is ideal for investors looking to build wealth steadily over time, while SWP is perfect for those who need regular income. By setting up and managing these plans, you can create a structured investment strategy tailored to your goals.

To get started, it’s always beneficial to consult a mutual fund distributor (MFD) like Shivakumar A, who can guide you through the process and help you choose the right funds based on your financial situation and risk profile. You can contact Shivakumar A, MFD, at 9886568000 for expert advice on how to begin your SIP or SWP journey.

Important Reminder: Mutual fund investments are subject to market risks. Please read the Scheme Information Document (SID) and Key Information Memorandum (KIM) carefully before investing.