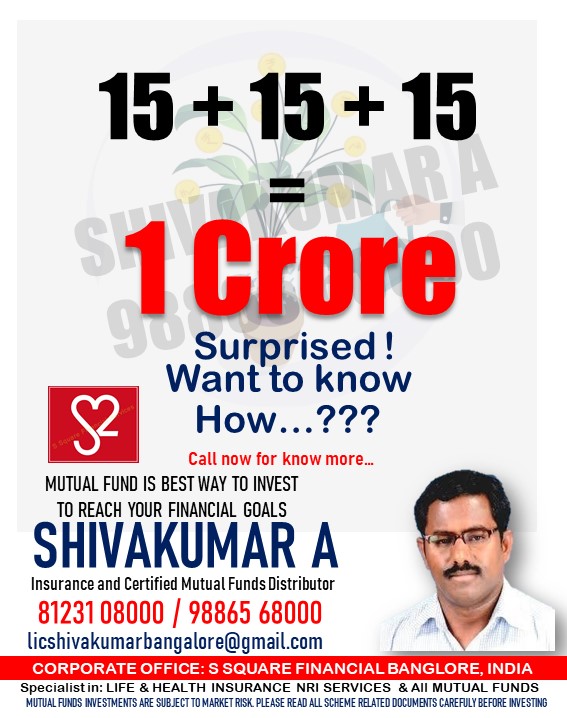

SIP with a Term Insurance policy

SIP with a Term Insurance policy is the best option for life coverage and saving for the future. Investment and Insurance must be kept separately. If you mix Insurance with Investment, the life coverage would be very costly.

Mr Arun, 35 years old, buys an Endowment plan with a sum-assured life cover of Rs. 2,00,00,000/- (Rs. 2 Crore) for a term of 15 years. The premium would be around Rs. 13,55,220/- per annum. At the end of the 15th year, the proposer would get a guaranteed Rs. 2,08,16,173/-.

Everyone would like to have a Term Insurance plan as per their capacity. How many people would be able to buy Rs. 2 Crore by paying Rs. 13,55,220/- per year?

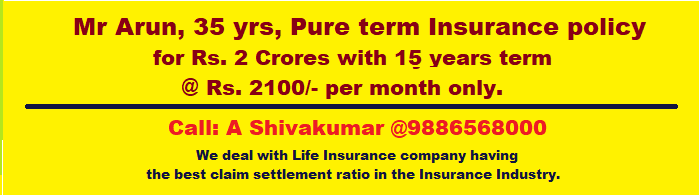

At the same time, Mr Arun buys a pure term plan for Rs. 2 Crores, as per his age, the premium for Rs. 2 Crore life insurance cover would be approx Rs. 2,200/- per month for the next 15 years.

The best option for Mr Arun would be to buy a Rs 2 Crores Term Insurance policy approx Rs. 2,200/- and invest Rs. 30,000/- per month in Mutual Funds SIPs.

Mr Arun would be the happiest person in the world to save such a huge money.

To start SIP with a Term Insurance policy, call 9886568000