SIP ELSS for Income Tax Savings

Understanding ELSS Mutual Funds: Tax Savings and Benefits

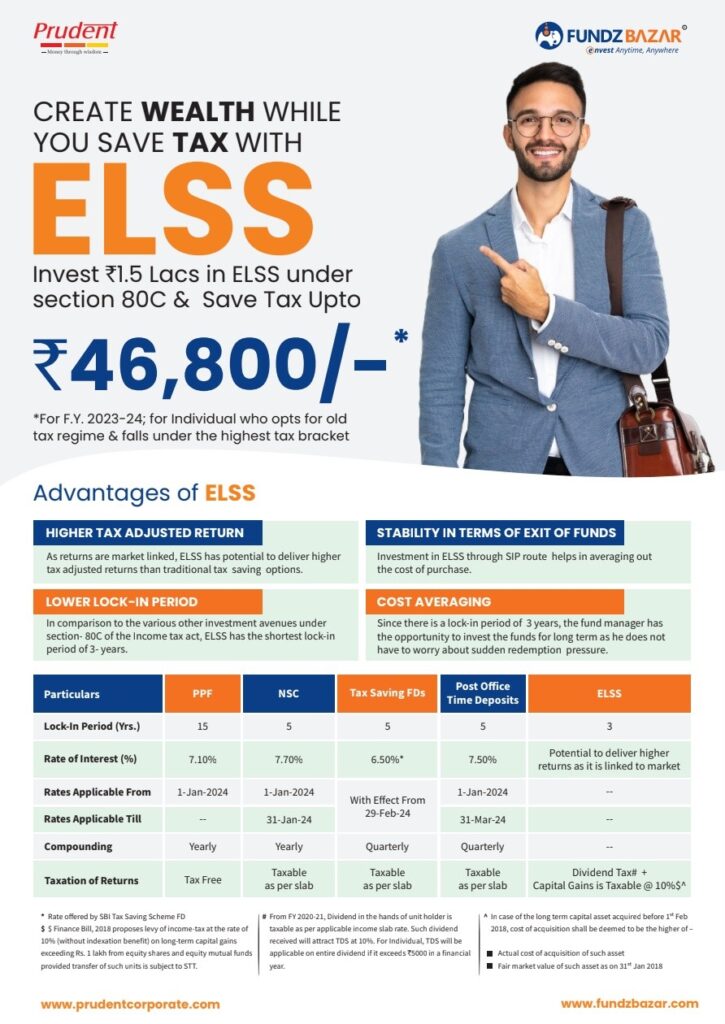

Equity Linked Savings Schemes (ELSS) are a popular category of mutual funds in India that offer tax-saving benefits under Section 80C of the Income Tax Act. ELSS mutual funds provide a unique combination of potential wealth creation and tax savings, making them an attractive investment option for many investors. This article delves into the benefits of ELSS, how they compare to traditional savings instruments like the Public Provident Fund (PPF), and the tax advantages they offer.

What Are ELSS Mutual Funds?

ELSS mutual funds are diversified equity mutual funds that come with a lock-in period of three years. They invest predominantly in equity and equity-related instruments, offering the dual advantage of capital appreciation and tax savings. Unlike other tax-saving instruments, ELSS funds have a relatively short lock-in period, providing greater liquidity while still offering significant tax benefits.

Benefits of ELSS Mutual Funds

1. Tax Savings

One of the primary benefits of investing in ELSS mutual funds is the tax deduction available under Section 80C of the Income Tax Act. Investors can claim a deduction of up to ₹1.5 lakh in a financial year, reducing their taxable income. This makes ELSS an effective tool for tax planning.

2. Potential for High Returns

ELSS mutual funds primarily invest in equities, which have the potential to generate higher returns compared to traditional debt instruments over the long term. Historical data suggests that equity investments tend to outperform other asset classes over extended periods, providing significant capital appreciation.

3. Short Lock-In Period

ELSS mutual funds have the shortest lock-in period among all Section 80C investments, at just three years. In comparison, other instruments like PPF, have a lock-in period of 15 years. This shorter lock-in period provides greater flexibility and liquidity to investors.

4. Diversification

Being diversified equity funds, ELSS mutual funds invest across various sectors and market capitalizations. This diversification helps mitigate risk and provides exposure to a broad range of companies and industries, enhancing the potential for returns.

5. Professional Management

ELSS funds are managed by experienced fund managers who make investment decisions based on thorough research and market analysis. This professional management can lead to better investment outcomes compared to individual stock picking.

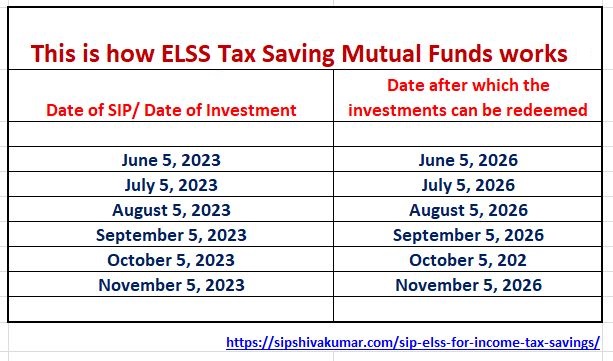

How does ELSS redemption happen?

Unlike other investments, ELSS, tax-saving Mutual Funds investment can be withdrawn after three years from the date of investment, An example is given below

Why ELSS is Better than PPF

While both ELSS and PPF offer tax-saving benefits under Section 80C, they differ significantly in terms of returns, lock-in periods, and flexibility.

1. Higher Returns

PPF offers a fixed rate of return, which is revised periodically by the government. Historically, the returns from PPF have been in the range of 7-8% per annum. On the other hand, ELSS funds, being equity-oriented, have the potential to deliver higher returns. Over the long term, ELSS funds have historically provided annualized returns in the range of 12–15%, significantly higher than PPF.

2. A shorter lock-In Period

PPF comes with a lock-in period of 15 years, making it a long-term investment with limited liquidity. ELSS funds, with a lock-in period of just three years, offer much greater liquidity. This allows investors to access their funds sooner if needed, providing more financial flexibility.

3. Inflation-Beating Returns

Given the equity exposure of ELSS funds, they have the potential to generate returns that outpace inflation. PPF, being a debt instrument, provides fixed returns that may not always keep up with inflation, thereby eroding the real value of the investment over time.

4. Investment Flexibility

ELSS funds offer greater flexibility in terms of investment amounts and frequency. Investors can start with a minimum investment and choose to invest either lump sum or through systematic investment plans (SIPs). PPF, on the other hand, has a maximum investment limit per financial year and does not offer SIPs.

Tax Benefits of ELSS

1. Tax Deduction

Investments in ELSS are eligible for tax deductions under Section 80C of the Income Tax Act, up to ₹1.5 lakh per financial year. This deduction reduces the investor’s taxable income, leading to significant tax savings.

2. Tax-Free Returns

The returns from ELSS investments, in the form of capital gains, are also tax-efficient. Long-term capital gains (LTCG) up to ₹1 lakh per financial year are tax-free. Gains above this threshold are taxed at 10%, which is lower than the highest income tax slab rates.

3. No Tax on Dividends

If an investor opts for the dividend option in an ELSS fund, the dividends received are tax-free in the hands of the investor, making it a tax-efficient way to earn regular income from the investment.

How to Start Investing in ELSS

Starting an investment in ELSS is a straightforward process. Here are the steps to get started:

1. Define Your Investment Goals

Determine your financial goals, risk tolerance, and investment horizon. ELSS funds are best suited for long-term financial goals such as retirement planning, children’s education, or wealth creation.

2. Choose the Right ELSS Fund

Research and compare different ELSS funds based on their past performance, expense ratio, fund manager’s track record, and the portfolio’s sector allocation. Choose a fund that aligns with your investment objectives and risk appetite.

3. Complete KYC Process

Ensure that you complete the Know Your Customer (KYC) process, which is mandatory for mutual fund investments. This involves submitting identity and address proofs such as Aadhaar, PAN card, passport, or voter ID.

4. Start Investing

You can invest in ELSS funds either through a lump sum investment or via SIPs. SIPs are recommended as they allow you to invest a fixed amount regularly, ensuring disciplined investing and rupee cost averaging.

5. Monitor Your Investment

Regularly review your ELSS investment to ensure it is on track to meet your financial goals. Make adjustments if necessary, based on changes in your financial situation or market conditions.

Contact for Assistance

For personalized guidance and to start your ELSS investment journey, you can contact Shivakumar at 948024013. As an experienced advisor, he can help you navigate the complexities of mutual fund investments and ensure you make informed decisions.

FAQs

Q1. Can I withdraw my ELSS investment before the lock-in period ends? A1. No, ELSS investments are locked in for three years, and you cannot withdraw the funds before this period.

Q2. Is there a maximum limit for investing in ELSS? A2. There is no maximum limit for investing in ELSS. However, the tax deduction under Section 80C is capped at ₹1.5 lakh per financial year.

Q3. Are ELSS returns guaranteed? A3. No, ELSS returns are not guaranteed as they are subject to market risks. The performance of ELSS funds depends on the underlying equity investments.

Q4. Can NRIs invest in ELSS? A4. Yes, non-resident Indians (NRIs) can invest in ELSS funds, subject to certain conditions and regulations.

Q5. What happens after the lock-in period of three years? A5. After the lock-in period ends, you can redeem your ELSS units or continue to stay invested to benefit from potential long-term capital appreciation.

ELSS mutual funds are an excellent investment option for those looking to save on taxes while benefiting from the potential of equity markets. With the dual advantages of tax savings and wealth creation, ELSS funds are a superior choice compared to traditional savings instruments like PPF. By investing through SIPs, investors can harness the power of compounding and rupee cost averaging, making ELSS a suitable option for long-term financial goals. For personalized advice and to start your investment journey, contact Shivakumar at 948024013.

Start ELSS Mutual Funds SIP, save maximum tax