Table of Contents

ToggleMutual Funds SIP start

Starting SIP Today: A Journey Towards Financial Freedom and Fulfillment

Click to invest: +919886568000

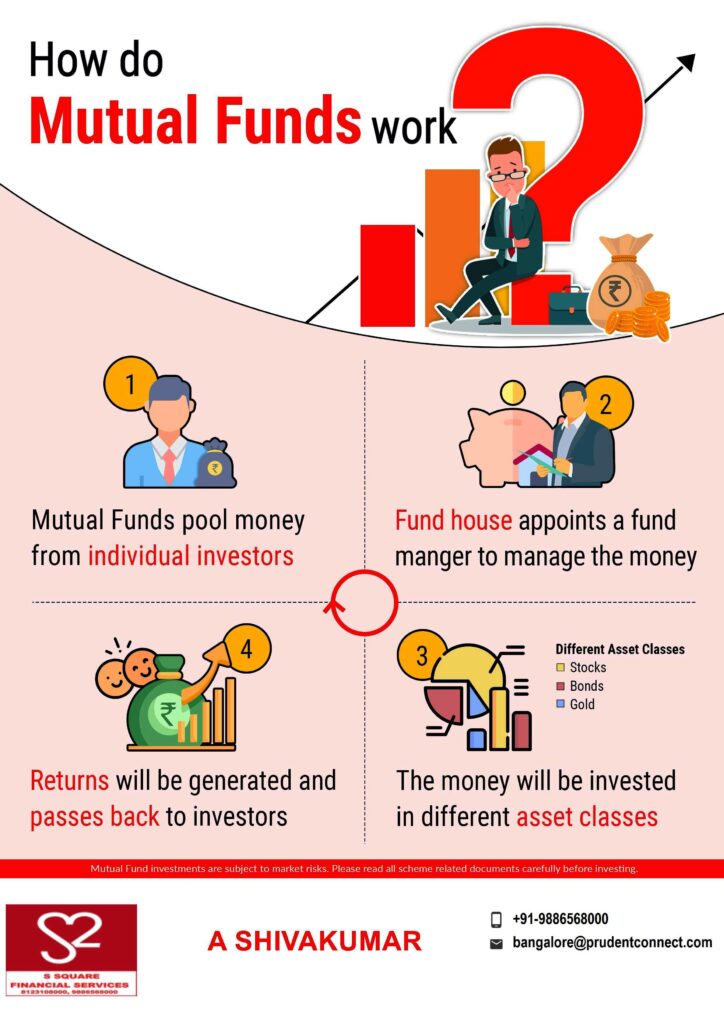

Start a mutual fund SIP and taste the growth of the stock market. Investing directly in the stock market requires research, knowledge, and huge funds. The Investor needs to buy and sell timely to avoid risks. The easiest way to make a profit from markets is by investing in Sips.

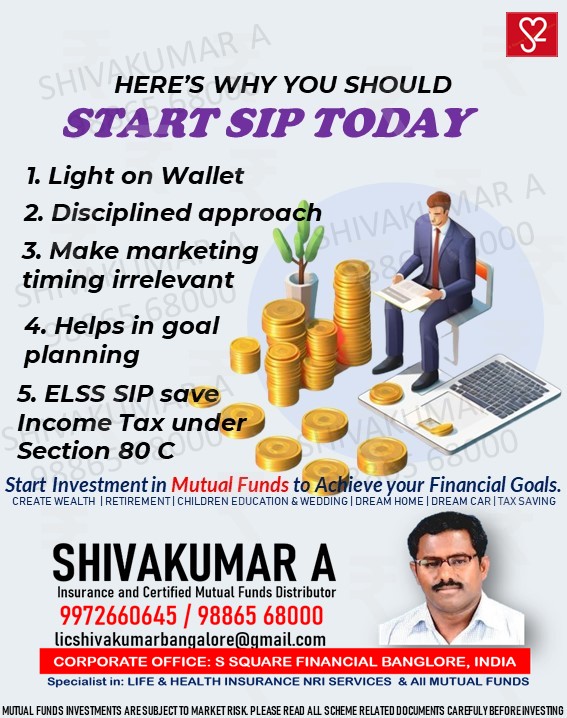

In the realm of personal finance, there’s a saying that goes, “The best time to start investing was yesterday, the next best time is today.” This timeless adage holds particularly true when it comes to systematic investment plans (SIP), a simple yet powerful tool for wealth creation and goal achievement. Whether you’re saving for education, buying a home, planning a dream holiday, funding your wedding, or preparing for retirement, starting SIP today can pave the way towards a brighter financial future. In this article, we’ll explore the myriad benefits of SIP and how they can help you achieve your financial aspirations while beating inflation and securing your future.

The mutual fund SIP can be fixed to a goal. Set Goals for every need and emergency purpose. There are many goals in everyone’s life, as per the lifestyle and budget of the family. Some Goals are common for most people, like:

-

- Sip for Child Education,

- Sip with a term plan,

- SIP for the dream car,

- Sip for the dream home,

- Sip for foreign travel,

- Sip for retirement

The investment should be made in such a way that it will be able to beat inflation and reach future goals. The investment should not be very low or very high. As per the earnings, and monthly Budget, the planning should be there.

Start SIP with a minimum of Rs. 1000/- per month.

Later, you can add more funds to the existing scheme. There are many categories in the Mutual Funds market. Sit with a mutual fund distributor, discuss, and choose the best from the top performing funds.

The timeline of the SIP should be a minimum of 5 years. It is like planting a seed, giving some to grow and the flowers and fruits to come is good.

The process of opening the SIP Account is very simple and easy. The account is free for a lifetime and no charges for buying or redeeming. The value of each unit will be updated on a day-to-day basis and the investor can easily track his investments.

Investors with no knowledge of the stock market can also invest, as a fund manager will take care of the buying and selling of shares in each fund or scheme.

The Power of Starting SIP Today:

1. Building Wealth Gradually:

SIPs offer a disciplined approach to investing, allowing you to contribute a fixed amount regularly into mutual funds. By starting SIPs today, you embark on a journey of gradual wealth accumulation, harnessing the power of compounding and rupee-cost averaging to grow your investments over time. Even small contributions can add up significantly over the years, helping you achieve your financial goals faster than you might think.

2. Achieving Financial Goals:

Whether it’s funding your child’s education, purchasing your dream home, planning a once-in-a-lifetime holiday, or saving for your wedding, SIPs can help you realize your aspirations. By setting specific financial goals and investing in SIPs tailored to those goals, you can create a roadmap towards achievement and fulfilment. SIPs offer the flexibility to align your investments with your objectives, ensuring that you stay on track towards making your dreams a reality.

3. Beating Inflation and Price Increases:

Inflation erodes the purchasing power of money over time, making it essential to invest in avenues that offer returns higher than the inflation rate. SIPs, particularly those invested in equity mutual funds, have historically outpaced inflation, providing a hedge against rising prices and preserving the value of your wealth. By starting SIPs today, you take proactive steps towards safeguarding your finances against inflationary pressures and price increases in the future.

4. Securing Your Future:

Whether you’re saving for retirement or building a financial safety net for unforeseen emergencies, SIPs can play a crucial role in securing your future. By consistently investing in SIPs, you create a pool of funds that can provide financial security and stability in the years to come. SIPs offer the advantage of liquidity, allowing you to access your investments when needed while still benefiting from long-term growth potential.

Tailoring SIPs to Your Goals:

1. SIPs for child education:

Investing in SIPs for education allows you to build a corpus to fund your children’s educational expenses. By starting SIPs early, you can take advantage of compounding to accumulate the necessary funds by the time your children reach college age.

2. SIPs for buying a home:

SIPs can help you save for a down payment on your dream home. By setting aside a portion of your income for SIPs, you can gradually build the funds needed to make a substantial down payment, reducing the burden of a home loan and accelerating your path to homeownership.

3. SIPs for a Dream Holiday:

Planning a dream holiday? SIPs can turn your travel aspirations into reality. By investing regularly in SIPs, you can accumulate the funds needed to embark on your dream getaway, whether it’s exploring exotic destinations, embarking on a cruise, or indulging in luxury travel experiences.

4. SIPs for marriage:

Getting married is a significant life event that often comes with substantial financial expenses. SIPs can help you save for your wedding expenses, from venue rentals to catering to honeymoon getaways. By starting SIPs early, you can ensure that you have the financial resources to celebrate your special day without financial stress.

5. SIPs for Retirement:

Saving for retirement is perhaps the most critical financial goal for many individuals. SIPs offer an ideal vehicle for retirement planning, allowing you to build a retirement corpus gradually over your working years. By starting SIPs early and investing in retirement-focused mutual funds, you can enjoy a comfortable retirement lifestyle free from financial worries.

In conclusion, starting SIPs today is a proactive step towards achieving your financial goals, beating inflation, and securing your future. Whether you’re saving for education, buying a home, planning a dream holiday, funding your wedding, or preparing for retirement, SIPs offer a versatile and effective investment strategy. By setting specific financial goals, tailoring your SIPs accordingly, and staying disciplined in your investment approach, you can embark on a journey towards financial freedom and fulfilment. Remember, the best time to start SIPs was yesterday, but the next best time is today. So why wait? Start your SIP journey today and pave the way towards a brighter financial future.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.