Life Insurance

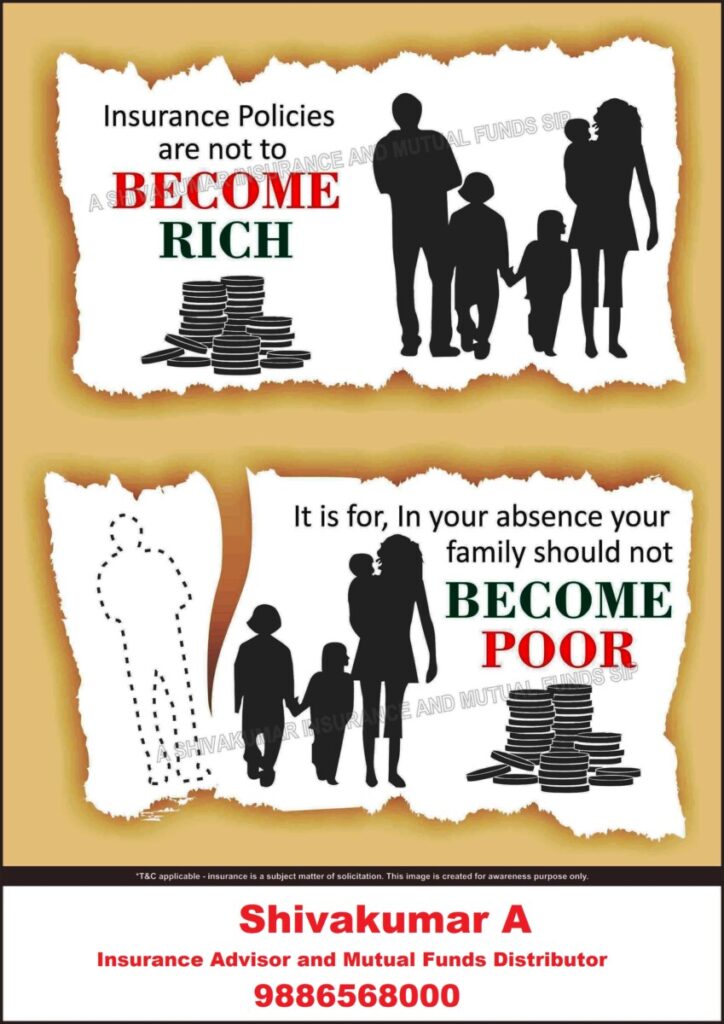

Life insurance, at its core, is a contract between an individual and an insurance provider, wherein the insurer agrees to pay a specified sum of money to the designated beneficiaries upon the insured’s demise or after a predetermined period. This financial protection serves as a crucial safety net, offering peace of mind and stability to policyholders and their families.

Life Insurance is the first step of everyone’s financial planning. The main purpose of Life insurance is to safeguard the family, Children and sometimes parents also. For every Life insurance proposer should see the claim settlement amount and the total number of cases settled in a particular year.

Never choose a life insurance company due to the lesser premium. The services may also be the same. The life cover is for your family and their well-being.

For Life Insurance and investment planning, call 9886568000

Life Insurance can save a complete family in case of any eventuality. A properly planned life insurance can save the life of all family members like spouse, children and parents. The Proposer should assess his responsibilities, liabilities, future needs, and retirement, then buy a big cover to safeguard all these.