Financial Planning for all

Financial Planning is a must for all investors. Never keep all your eggs in one place. Invest in Life Insurance, Health Insurance, Tax Planning, Fixed Deposits, Mutual Funds, Shares, Real Estate, Gold, Silver etc. The investor always tries to save funds and taxes for a better future. Proper planning with a mix of investments is good for the future.

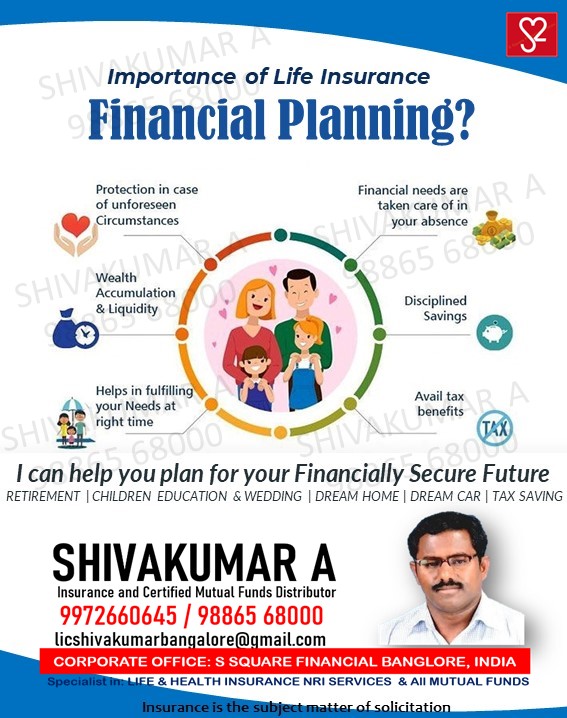

Life Insurance in Financial Planning

Life Insurance has become more than an asset after Corona pandemic disease. Request the head of the family to buy a Term Assurance plan for a minimum of Rs. 1 Crore. The family may have Crores of Rupees invested in various places, but when the news spreads about the loss of the head of the family, most of the people vanish. Life Insurance is the only instrument that pays to the nominee without any delay.

The allocation in each may vary from person to person according to their budget and lifestyle. Those who diversified their investments never lost money. The policyholder should not see any returns from Insurance. You are never late to buy an Insurance. Buy as soon as possible.

Health Insurance in Financial Planning

Health Insurance was a basic need during the Corona, COVID-19 days. There was not much awareness of Health Insurance before Corona’s time. People used to depend mainly on Company Health insurance benefits. During and after the coronavirus pandemic Disease, people started to buy health insurance in addition to the Company’s health policy. Buy Health insurance plans which cover all members of the family for at least Rs. 50 lakhs or more. Buy Health insurance when you are fit and healthy. Never delay Insurance.

Mutual Funds and Shares in Financial Planning

In your portfolio, Mutual Funds and shares should have a place as per your lifestyle. Although the returns are subject to market returns, proper planning and calculated investment in Mutual Funds and Shares may provide the best returns in the future.

Tax Savings in Financial Planning

For comparison, Investments in Insurance, Mutual Funds, and NPS, Mutual Funds had given a far better return. The main advantage is withdrawing whenever you want after 3 years completion from the date of investment,

Gold and Silver in Financial Planning

Investment in Gold and Silver has been done for decades. Both metals had given good returns from time to time. Keeping Gold at home may not yield any returns. Many Banks have come up with a Gold Deposit scheme. The customers can deposit their idle gold under R- GDS which will provide them safety, interest earnings, and a lot more.

Fixed Deposits in Financial Planning

Fixed Deposits are very much required as liquid money should be at any time reachable distance. Fixed Deposits help the investors within days. A portion of the investment budget should be invested in the Fixed Deposit schemes, which can be withdrawn when required without disturbing any other investments. You can open a Fixed Deposit account with the same bank and link your Bank account.

Real Estate in Financial Planning

In the past, Real estate had provided very good returns but during the Corona illness time, due to the lockdown, the Real Estate market crashed and went to its lowest level. Now the Real estate market is slowly coming to normalcy. A Well-guided investment in the real estate field may provide good returns in the future.

Conclusion

Diversification is a must for safety and growth. Spread your investments across all financial instruments to decrease the risk of getting returns. Invest in such a way that the investment never comes down, and the returns are also safe.

Call Shivakumar at 9886568000 to diversify your investment