Asset Allocation – Mutual Funds

# Mutual Funds: A Gateway to Diversified Investing

Investing can be a complex and daunting task, especially for those new to the financial markets. Mutual funds offer a solution by providing a straightforward and diversified investment option. Here’s how they can benefit your financial portfolio.

## What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. This collective investment structure is managed by professional fund managers who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors.

## Benefits of Investing in Mutual Funds

### Diversification

One of the primary advantages of mutual funds is diversification. By investing in a range of assets, mutual funds reduce the risk of loss from any single investment. This diversification helps to mitigate the impact of market volatility on your investment.

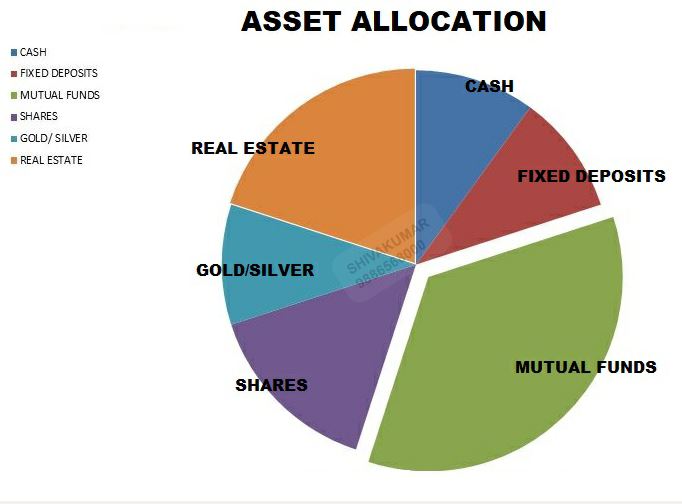

Asset Allocation should be done based on investors’ age, lifestyle, earnings, needs and future goals. One plan may not help the other investor. Asset allocation will not be the same for the same age people. If the same age also, It differs from person to person.

### Professional Management

Mutual funds are managed by experienced fund managers who have the expertise to analyze market trends and make informed investment decisions. This professional management can be particularly beneficial for investors who lack the time or knowledge to manage their own portfolios.

### Affordability

Mutual funds allow investors to participate in a diversified portfolio with a relatively small amount of capital. This affordability makes it easier for individuals to start investing and benefit from the potential for long-term growth.

### Liquidity

Mutual funds offer high liquidity compared to other investment options. Investors can easily buy or sell their shares of a mutual fund at the current net asset value (NAV), which is calculated at the end of each trading day.

### Flexibility

With a wide variety of mutual funds available, investors can choose funds that align with their investment goals, risk tolerance, and time horizon. Whether you’re looking for income, growth, or a combination of both, there’s a mutual fund that can meet your needs.

### Transparency

Mutual funds are subject to regulatory oversight and are required to provide investors with detailed information about the fund’s objectives, holdings, performance, and fees. This transparency allows investors to make informed decisions about their investments.

## Conclusion

Mutual funds offer a range of benefits that make them an attractive option for both novice and experienced investors. Their ability to provide diversification, professional management, affordability, liquidity, flexibility, and transparency can help individuals achieve their financial goals. As with any investment, it’s important to conduct thorough research and consider your financial situation before investing in mutual funds.

Remember, the key to successful investing is not just selecting the right investment, but also understanding how it fits into your overall financial plan. Mutual funds can be a valuable component of a well-rounded investment strategy.

Start SIP in Mutual Funds, call 9886568000 to start a free account