Table of Contents

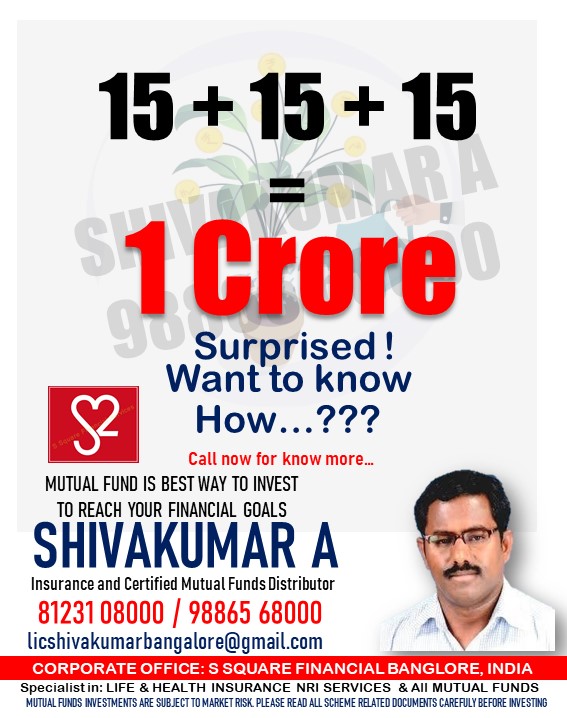

ToggleWealth Creation with Mutual Funds SIP

*Start Mutual funds SIP by calling 9886568000

In today’s fast-paced financial landscape, individuals seek investment avenues that not only offer potential for wealth creation but also provide a hedge against inflation and secure retirement. Mutual funds, particularly through systematic investment plans (SIPs), have emerged as a popular choice due to their simplicity, diversification benefits, and ability to beat inflation. This article explores how mutual funds SIP can serve as a powerful tool for wealth creation, beating inflation, and securing a comfortable retirement through strategies like diversified investment and systematic withdrawal plans (SWP).

Wealth Creation with Mutual Funds SIP:

Mutual funds SIP allows investors to contribute a fixed amount regularly into mutual funds of their choice, enabling them to accumulate wealth over time through disciplined investing. One of the key advantages of SIPs is rupee cost averaging, where investors buy more units when prices are low and fewer units when prices are high, thereby reducing the average cost per unit over the long term.

By investing in a diversified portfolio of mutual funds across various asset classes such as equities, debt, and hybrid funds, investors can spread their risk and potentially enhance returns. Diversification not only mitigates the impact of market volatility but also taps into the growth potential of different sectors and industries, thereby maximizing wealth creation opportunities.

Beating Inflation with Mutual Funds SIP:

Inflation erodes the purchasing power of money over time, making it essential for investors to seek avenues that offer returns exceeding the inflation rate. Equities, historically known for outperforming inflation in the long run, form a significant component of many mutual funds SIP portfolios. By investing in equities through SIPs, investors position themselves to benefit from the growth potential of businesses and economies, thereby effectively beating inflation.

Additionally, certain categories of mutual funds, such as equity-oriented hybrid funds and thematic funds, may offer inflation-beating returns by focusing on specific sectors or themes poised for growth in the economy.

SWP with Mutual Funds SIP for Retirement:

As investors approach retirement, the focus shifts from wealth accumulation to generating a regular income stream to meet expenses and maintain a desired lifestyle. Systematic withdrawal plans (SWP) offered by mutual funds allow retirees to systematically withdraw a predetermined amount at regular intervals from their investment corpus.

By setting up SWP with mutual funds SIP, retirees can enjoy the twin benefits of wealth accumulation during their working years and a steady income stream during retirement. The systematic withdrawals can be tailored to match the retiree’s financial needs and risk tolerance, while ensuring that the investment corpus continues to grow and beat inflation over the long term.

To be frank, mutual funds SIPs offer a versatile and effective solution for wealth creation, beating inflation, and securing a comfortable retirement. Through disciplined investing, diversification, and strategic use of SWP, investors can harness the power of mutual funds to achieve their financial goals and aspirations, regardless of market conditions or economic uncertainties.

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully.