SIP for all

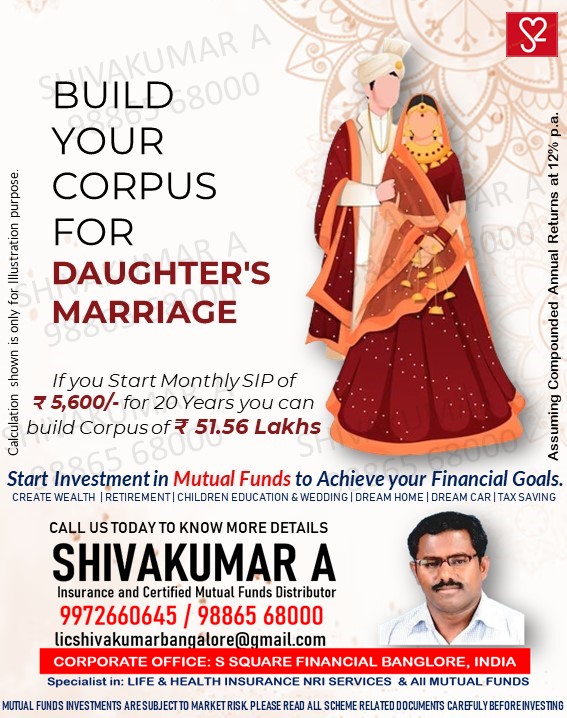

SIP for all from the age of starting a job till the last day. There are many benefits of starting an SIP, enjoying month on month. Systematic Investment Plan – SIP can be linked to personal goals like Child Education, Higher Education, Marriage Planning, buying a dream car, buying a Home, Planning for a foreign tour, Income Tax Planning, retirement planning and so on.

SIP term is misunderstood by many. SIP means SYSTEMATIC INVESTMENT PLAN, It means the mode of payment to buy Mutual Funds. The investor can invest in Mutual Funds through SIP or lump sum payment.

The investment depends on the NAV – Net Asset Value of the SIP Units. The more you accumulate, the more returns you can expect. So regular investment in Mutual Funds by way of SIPs will benefit the investor

|

|

|

The advantage of SIP in mutual funds is you can start, stop, pause, or redeem at any time. The tax laws are also very simple in the mutual fund investment.

Tax Rules on SIP Investments for Indian Individuals:

| TAX | % of the profit |

| Short-term Capital gain on the profits you make by selling within one year from the date of Investment | 15% |

| Long Term Capital gain on the profits you make by selling after one year from the date of Investment | 10% |